St. Paul, MN (January 7, 2019) — According to Michael Guckes, Chief Economist for Gardner Intelligence, the average reading for the Gardner Business Index (GBI) in 2018 was 56.9, registering as the highest average in the Index’s history.

During the 2018 calendar year, the Index averaged 56.9, setting the highest calendar year average reading in the Index’s history. Based on the recent trends in new orders, production and supplier deliveries, Gardner will be paying careful attention in early 2019 to how well manufacturers handle the transition toward more historically typical rates of growth after experiencing nearly two-years of extraordinary expansion.

The latest reading fell 5.9 percent compared to the same month one-year ago. Gardner Intelligence’s review of the underlying data for the month indicates that the Index – calculated as an average – was supported by supplier deliveries, production, new orders and employment. The components which lowered the Index included backlog and exports, both of which contracted.

The latest reading fell 5.9 percent compared to the same month one-year ago. Gardner Intelligence’s review of the underlying data for the month indicates that the Index – calculated as an average – was supported by supplier deliveries, production, new orders and employment. The components which lowered the Index included backlog and exports, both of which contracted.

Employment recorded a small expansionary increase while all other components moved lower during the month. Production and new orders both expanded at their slowest rates since late 2016 after peaking early in the year. The impact of slowing new orders and production has significantly altered the backlog picture which in the first quarter of 2018 recorded its highest reading in history before recording contractionary readings during the last two months of the year.

For the eighth month, supplier deliveries maintained its position as the fastest-expanding component of the Index. Growth in supply chain capacity combined with relatively slower growth in new orders as compared to production in recent months may presumably account for the sharply different backlog readings recorded at the start and end of the year.

Based on the recent trends in new orders, production and supplier deliveries, Gardner will be paying careful attention in early 2019 to how well manufacturers handle the transition toward more historically typical rates of growth after experiencing nearly two-years of extraordinary expansion. This transition may result in some components posting unattractive recordings – as evidenced by recent backlog readings – in the short run.

The fastest growing industries during the month were plastics/rubber products, pumps/valves/plumbing products, power generation, primary metals, aerospace, construction machinery, oil & gas, industrial motors/hydraulic/mechanical components, medical, custom processors, machinery/equipment, automotive, electronics/computers/telecommunications, and metalcutting job shops. All other industries tracked by Gardner Intelligence contracted during the month.

In addition to the overall durable goods index, Gardner Intelligence computes indices for several technologies or processes. For the month, Composites, was the fastest growing technology; it was followed by Metalworking, Moldmaking, Finishing, Precision Machining and Plastics. All technologies expanded during the month.

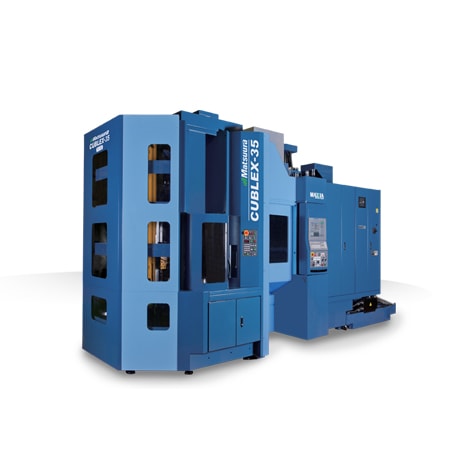

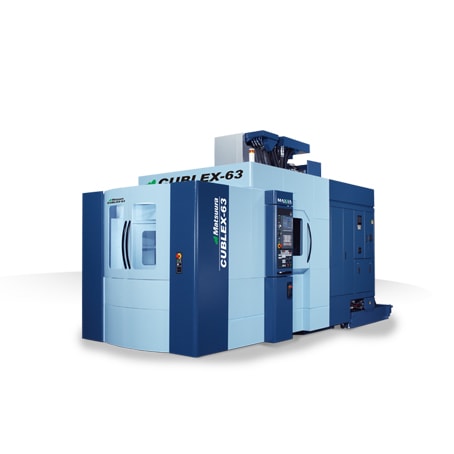

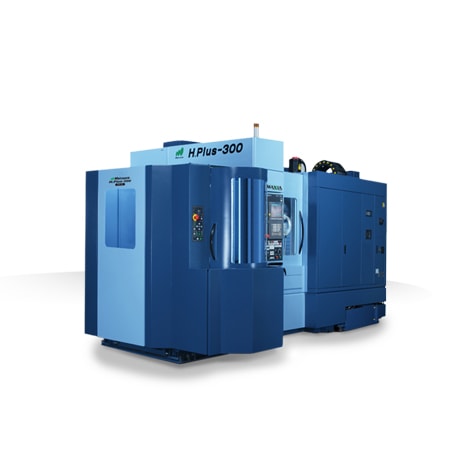

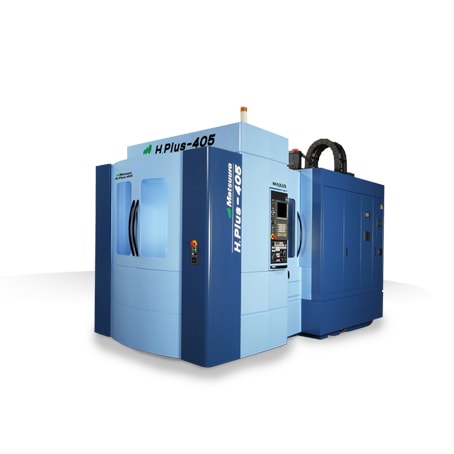

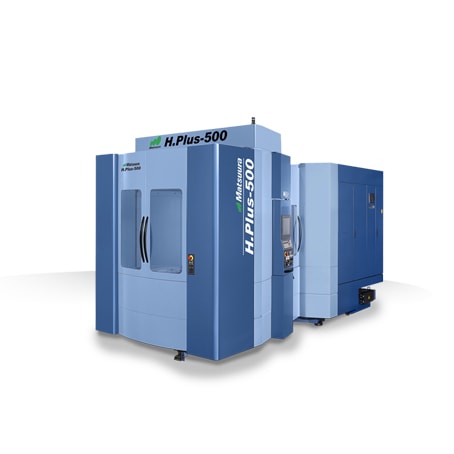

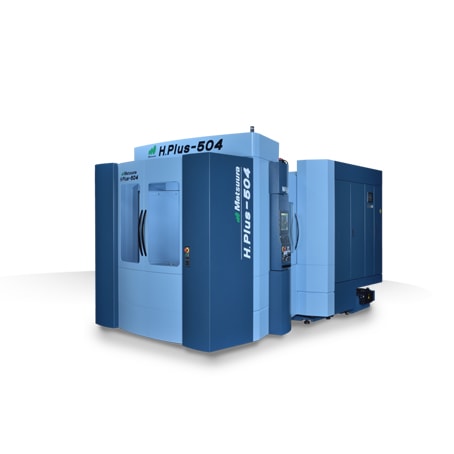

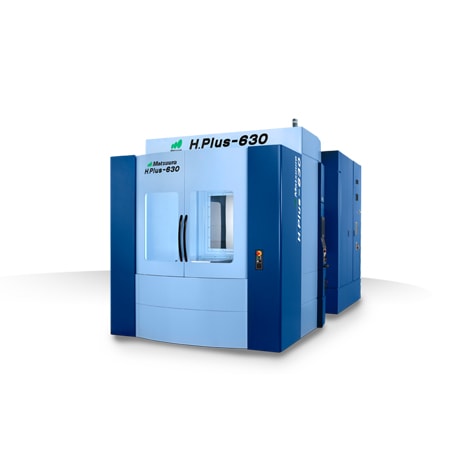

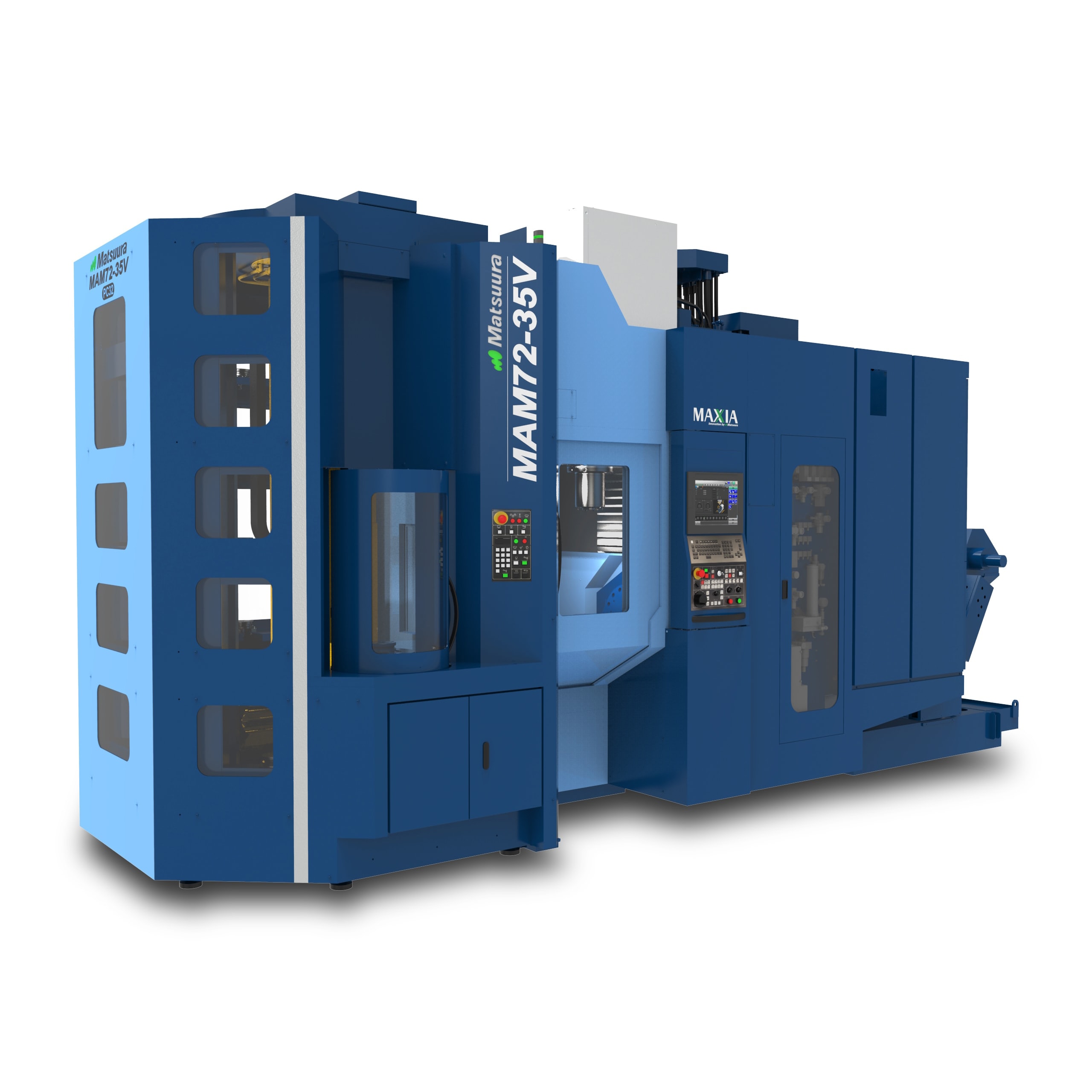

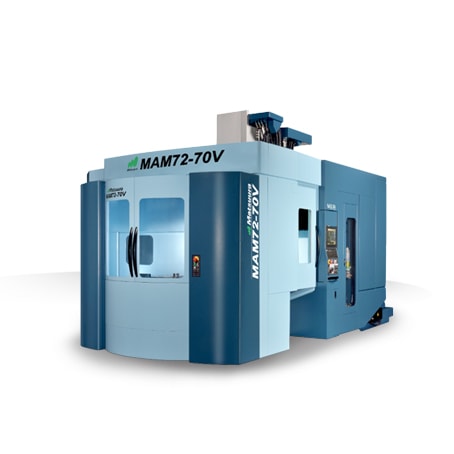

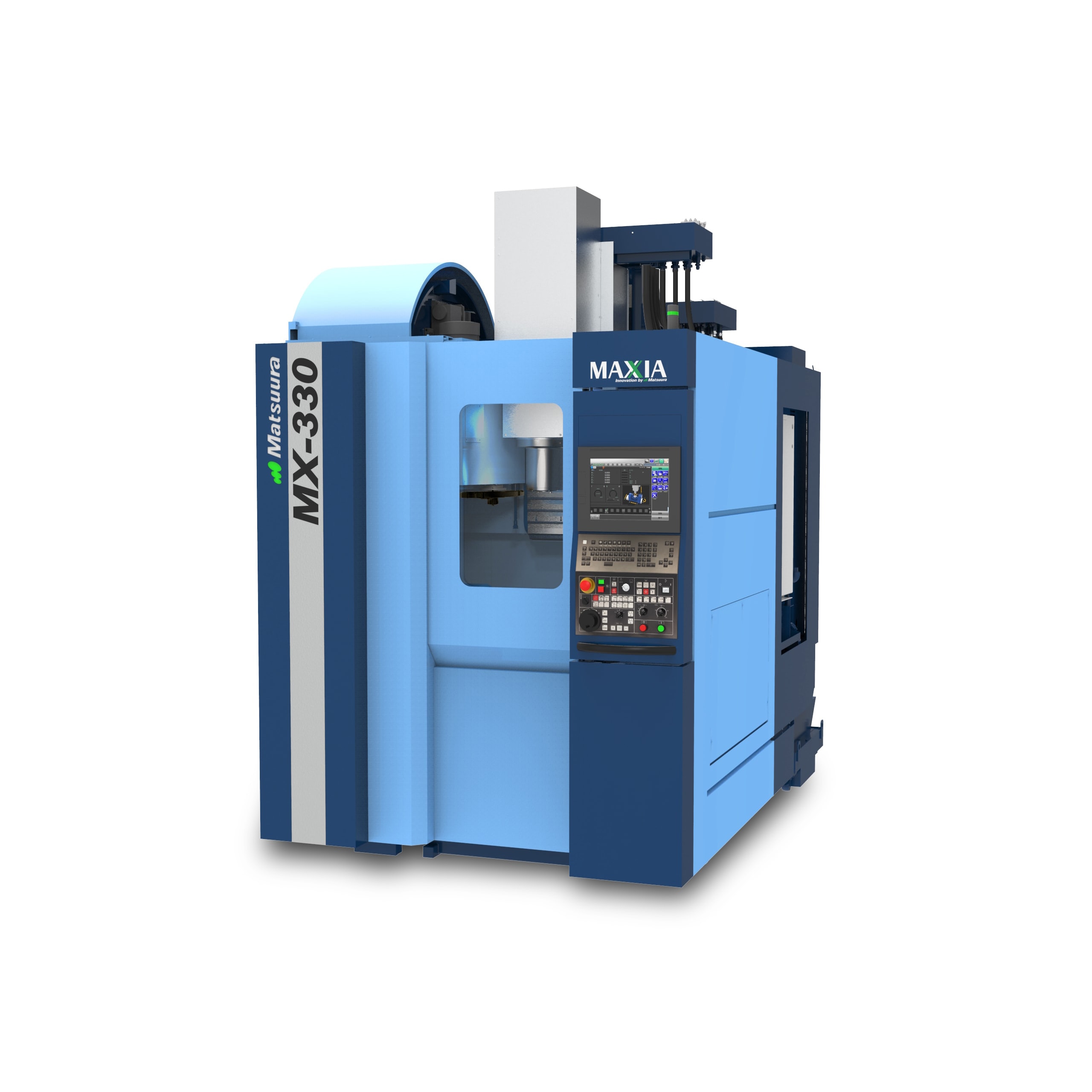

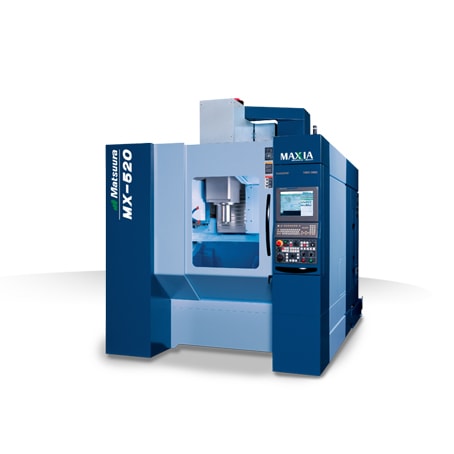

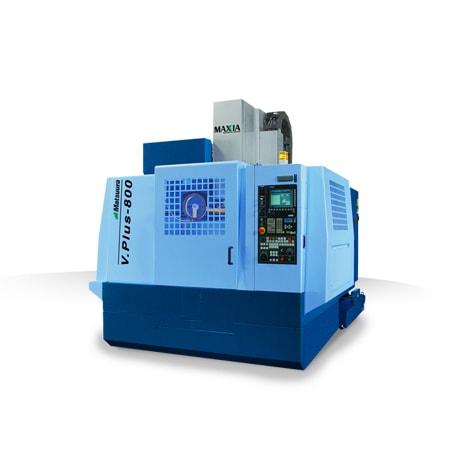

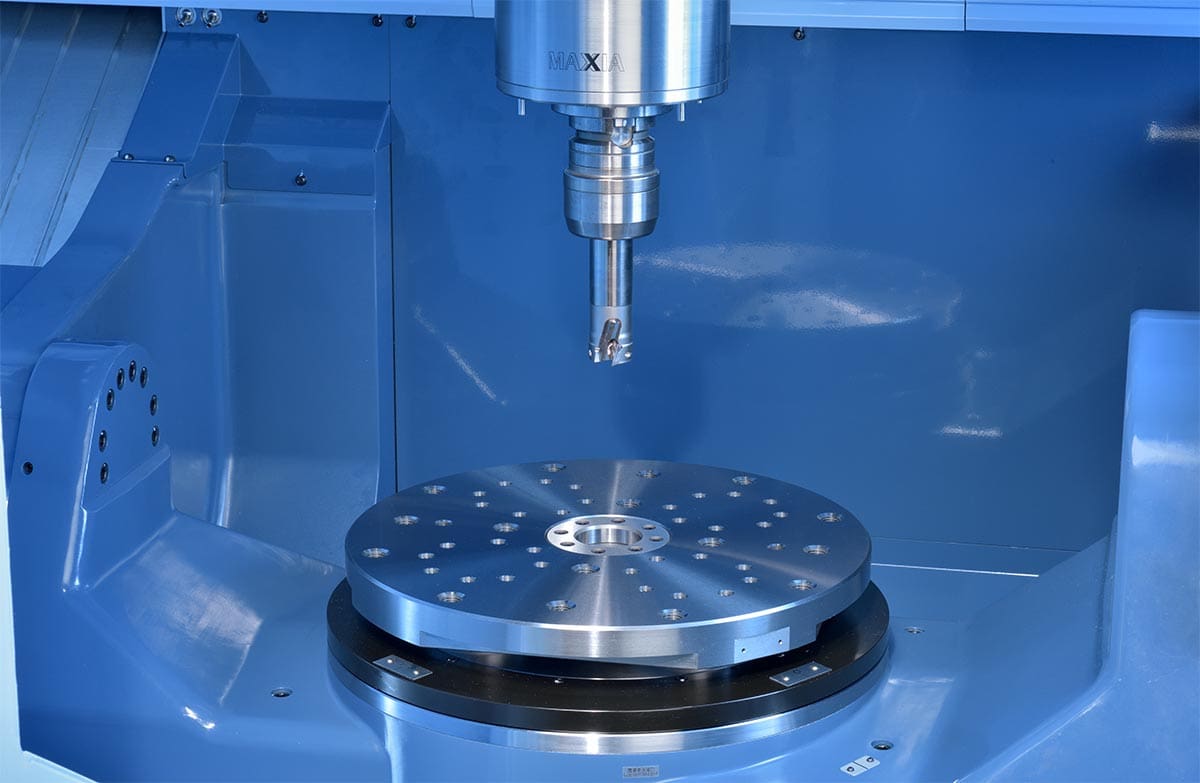

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. delivers unmatched excellence in 5-axis, vertical, horizontal, linear motor, multi-tasking CNC machine tools and machines with a powder bed metal AM platform with machining capability. Matsuura Machinery USA, Inc. provides the service, applications and technical field support that have always been the Matsuura standard for business. For more information on Matsuura products, contact: [email protected] or visit: www.matsuurausa.com.