St. Paul, MN (August 14, 2019) —According to Steven Kline, Jr., Chief Data Officer for Gardner Business Media, Metalworking has contracted since the first quarter of 2019 and is pointing towards a contraction in machine tool orders starting between July and September.

St. Paul, MN (August 14, 2019) —According to Steven Kline, Jr., Chief Data Officer for Gardner Business Media, Metalworking has contracted since the first quarter of 2019 and is pointing towards a contraction in machine tool orders starting between July and September.

June machine tool orders were 2,123 units and $353,401,000. Unit orders for the month contracted 2.2% compared with one year ago, marking contraction for the fifth straight month and six of the last seven months. Annually, unit orders continued to grow at a slower rate, but they are likely to contract next month.

June dollar orders contracted 15.8% compared with one year ago, mirroring unit orders by contracting for the fifth straight month and six of the last seven months. However, while the unit contraction was relatively muted, the dollar contraction was more than 10% each of the last five months. Annually, dollar orders contracted in June for the first time since February 2017.

Despite the month-over-month contractions and overall contraction at the national level, there were pockets of strength in machine tool orders in June. The West recorded increases in both units and dollars – 15.2% and 2.8%, respectively – this month. The South Central region had a 2.3% increase in units, and the Northeast recorded a 7.6% increase in units.

However, all of these gains were not able to overcome the weakness in the two largest regions – the North Central-West and North Central-East. Units in the North Central-West contracted for the ninth month in a row, falling 12.5% while dollar orders were down 39.3%. Annually, they are contracting for the fourth and third month, respectively. In the North Central-East, units were down 4.9% and dollars were down 7.2%, both contracting annually.

Industrial production and capacity utilization both recorded decelerating growth for the fourth consecutive month in May. Additionally, both the money supply and the GBI: Metalworking have been negative leading indicators for future machine tool orders for a number of months. On the positive side, the change in the real 10-year Treasury rate has moved in a positive direction for capital equipment for several months. It is likely that machine tool orders will see an annual rate of contraction next month.

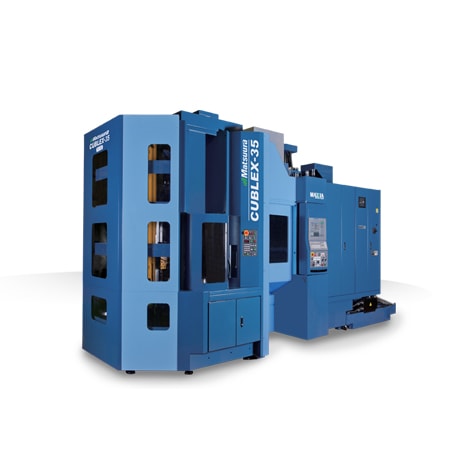

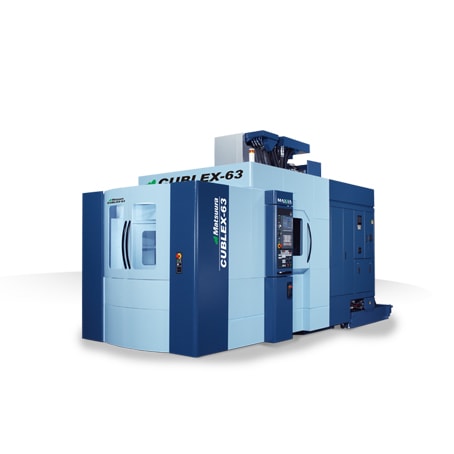

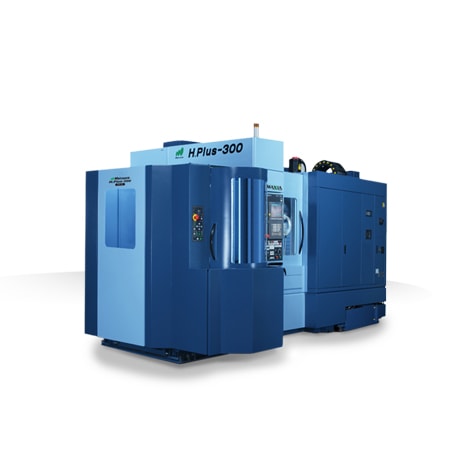

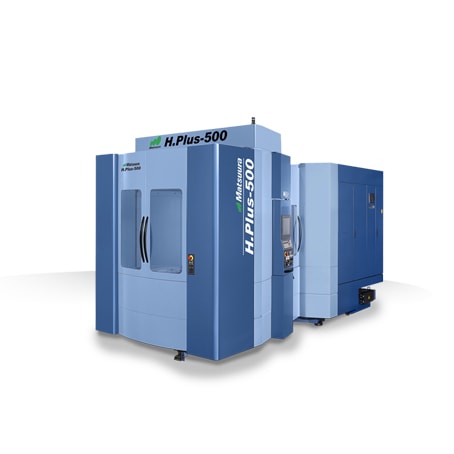

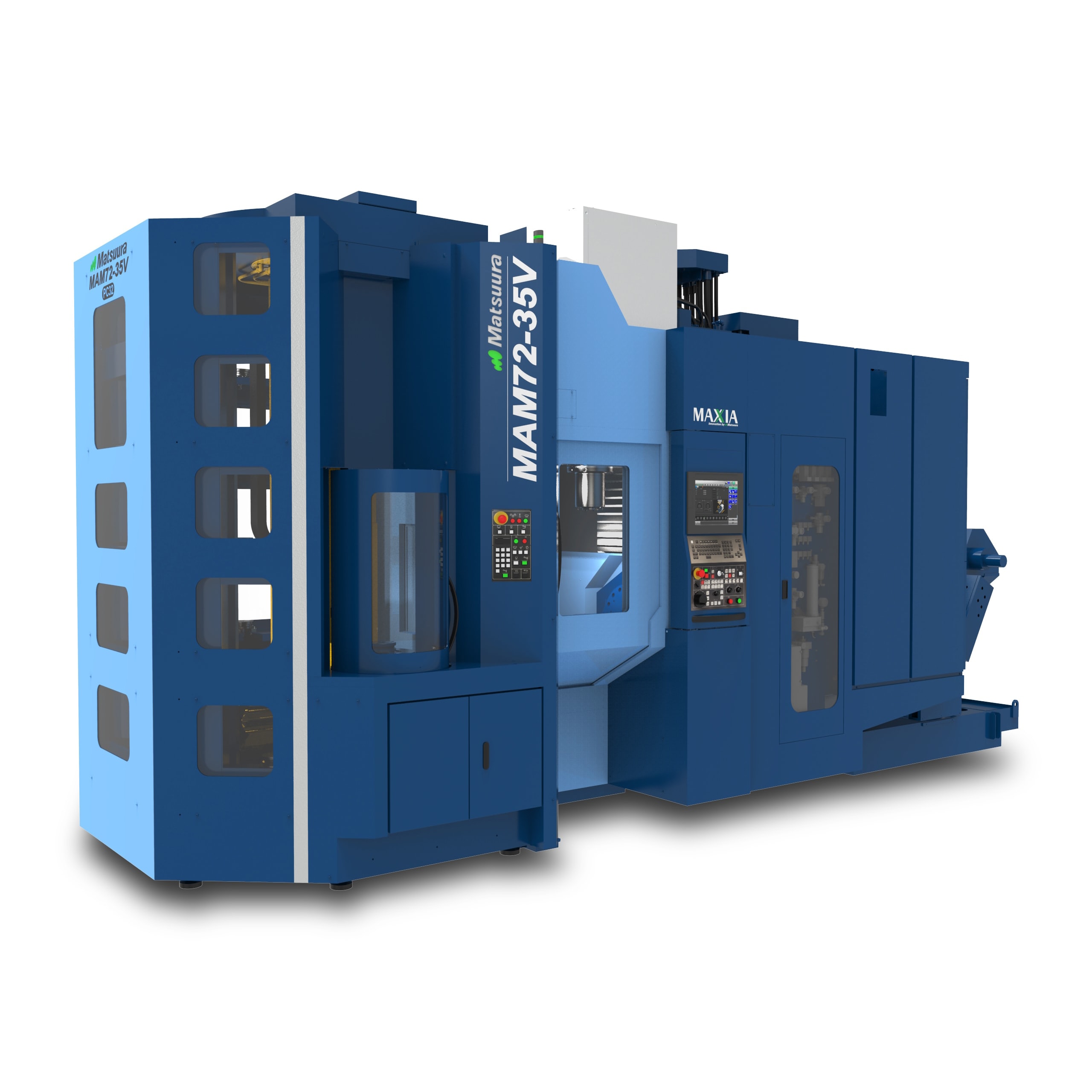

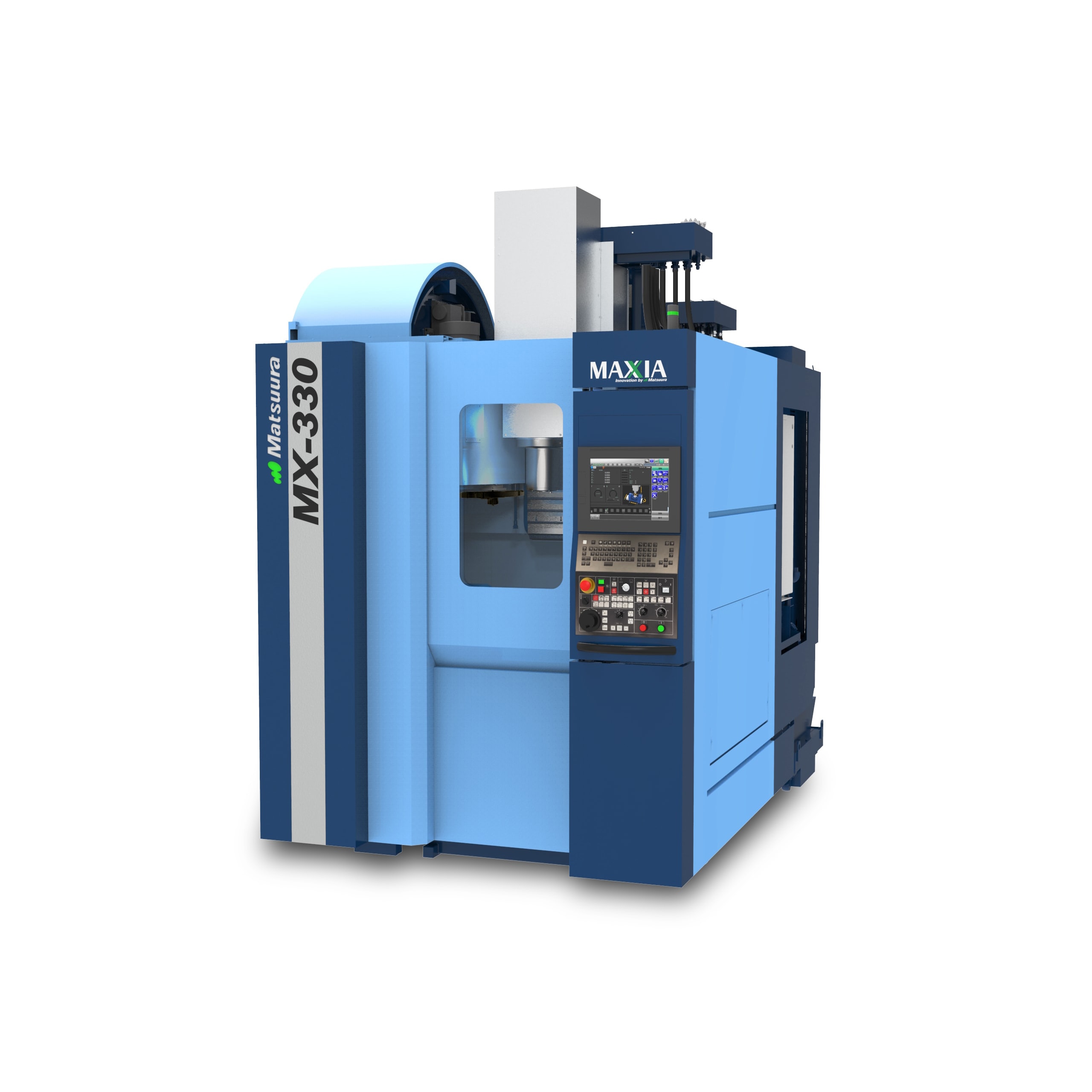

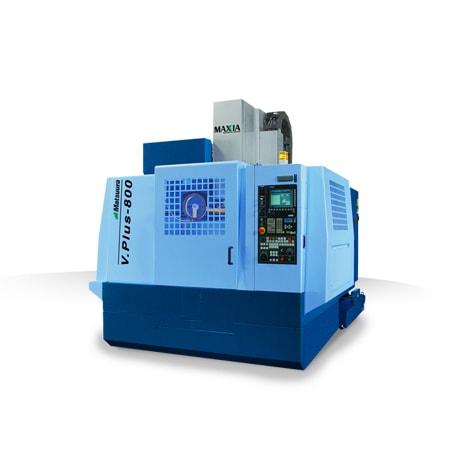

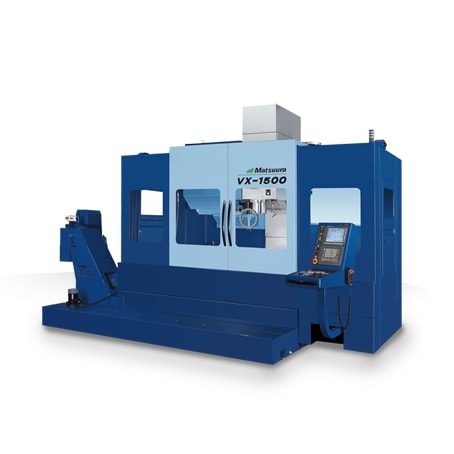

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. delivers unmatched excellence in 5-axis, vertical, horizontal, linear motor, multi-tasking CNC machine tools and machines with a powder bed metal AM platform with machining capability. Matsuura Machinery USA, Inc. provides the service, applications and technical field support that have always been the Matsuura standard for business.

Please visit: https://www.gardnerintelligence.com/Economics/post/data-shows-pockets-of-strength-in-machine-tool-orders to read more.

For more information on Matsuura products, contact: [email protected] or visit: www.matsuurausa.com.