St. Paul, MN (January 18, 2018) —— The US government recently implemented substantial modifications to the Section 179 Expensing and Bonus Depreciation Taxes.

St. Paul, MN (January 18, 2018) —— The US government recently implemented substantial modifications to the Section 179 Expensing and Bonus Depreciation Taxes.

Matsuura Machinery USA, Inc. would like to provide the following information on the tax changes:

SECTION 179 EXPENSING

Current Law: Businesses may immediately expense up to $500,000 (adjusted for inflation – $510,000 for 2017) of the cost of any §179 property placed in service each tax year. If the business places in service more than $2 million (adjusted for inflation – $2,030,000 for 2017) of §179 property in a tax year, then the amount available for immediate expensing is reduced by the amount by which the cost of such property exceeds $2 million (as adjusted). Further limitations on the ability to immediately expense this amount may apply based on the business’s taxable income for the year.

Act: Effective for taxable years beginning after December 31, 2017, the Act increases the amount that a taxpayer may expense under §179 from $500,000 to $1,000,000 and increases the phase-out threshold from $2,000,000 to $2,500,000. Further limitations on the ability to immediately expense this amount may apply based on the business’s taxable income for the year.

BONUS DEPRECIATION

Current Law: Taxpayers receive an additional depreciation deduction in the year in which it places certain “qualified property” in service (bonus depreciation), effective for property placed in service through 2019. The amount of bonus depreciation is 50% of the cost of such property placed in service during 2017.

Act: The Act extends the availability of bonus depreciation for qualified property plants for three additional years, and increases the bonus depreciation percentage to 100%, effectively allowing taxpayers to deduct immediately the full cost of qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

The Act begins to phase down the percentage that may be expensed for property placed in service after January 1, 2023, as follows:

- For property placed in service before January 1, 2023, 100% expensing.

- For property placed in service after December 31, 2022, and before January 1, 2024, 80% expensing.

- For property placed in service after December 31, 2023, and before January 1, 2025, 60% expensing.

- For property placed in service after December 31, 2024, and before January 1, 2026, 40% expensing.

- For property placed in service after December 31, 2025, and before January 1, 2027, 20% expensing.

Alternatively, the Act allows taxpayers to elect 50% in lieu of 100% expensing for qualified property placed in service during the first tax year beginning after September 27, 2017.

Matsuura Machinery USA, Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

According to Marketwatch.com and SandlerResearch.org, the machining center market will surpass $5 Billion by 2020.

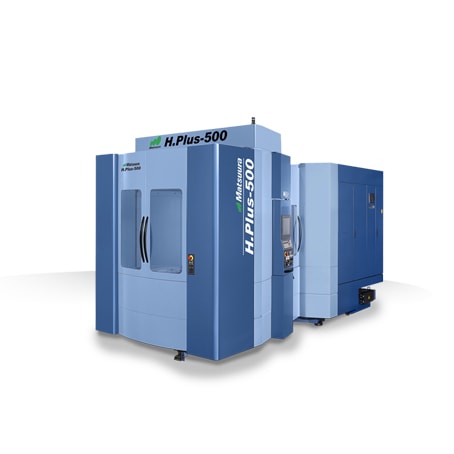

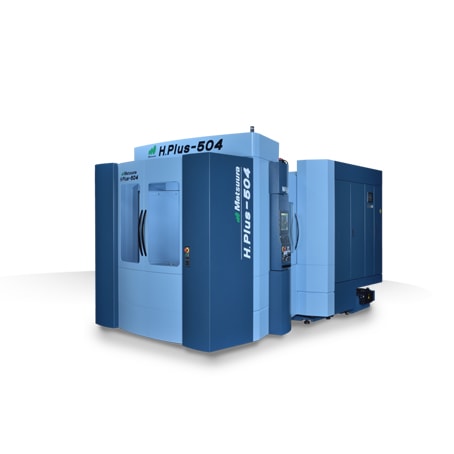

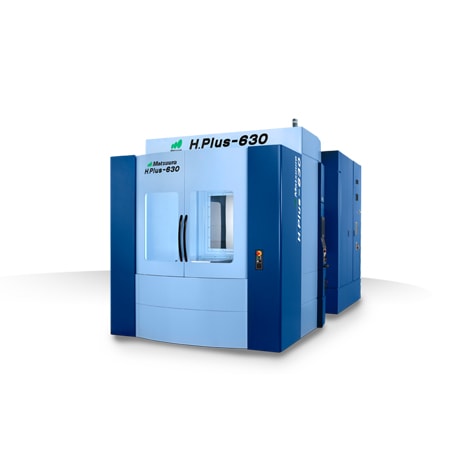

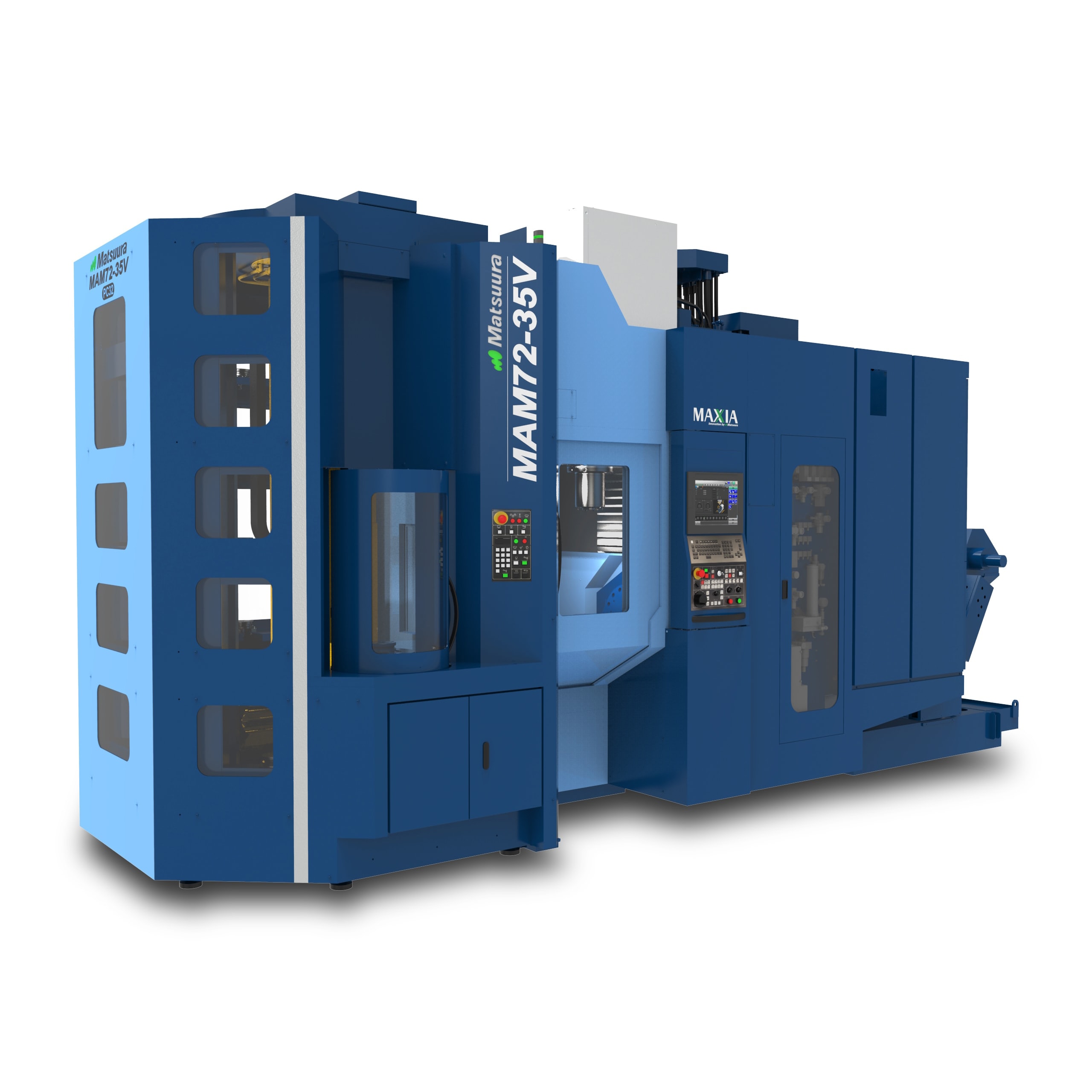

As manufacturing in North America becomes more complex, requiring multi-axis machining solutions, Matsuura is the preeminent solutions provider. While most industries maintain a higher part mix and smaller batch production, reduction of inventory is an imperative initiative. Additionally, with pressure on pricing and margins, customers realize they must discover methods to reduce labor costs.

The analysts forecast global machining center market to grow at a CAGR of 5.68% during the period 2016-2020. According to the machining center market report, growing demand for fabricated metal products will be a key driver for market growth. The global fabricated metal products market was valued at $1.81 trillion in 2015 and will likely reach $2.35 trillion by 2020, growing at a CAGR of 5.36%. The US accounted for almost 20% of the entire global fabrication metal product market. There is an increase in the demand for US-manufactured fabricated metal products worldwide. For example, Mexico, Canada, and China rely heavily on the US for the supply of fabricated metals. Increased fabricated metal production in the country is leading to rising domestic demand for machine tools.

According to machining center market research and analysis, the automotive industry accounted for more than 41% of the total market shares and dominated the industry during 2015. This industry uses machining centers in various metal processing operations like cutting, drilling, and surface cleaning of the metal sheets used in the fabrication of automotive parts. The expected growth of the automotive industry all over the world, especially in the emerging markets will bolster the market’s growth prospects in the coming years.

Matsuura is a key player in the global machining centers market.

Matsuura Machinery’s exclusive distributor network works alongside Matsuura to define the ideal manufacturing method and oversee the complete project – from concept to production, from training to after sales technical and service support.

To discover how Matsuura’s automation and advanced technology provide a competitive advantage by acquiring engineering solutions for your manufacturing challenges; contact your exclusive Matsuura distributor or contact Matsuura USA at [email protected].

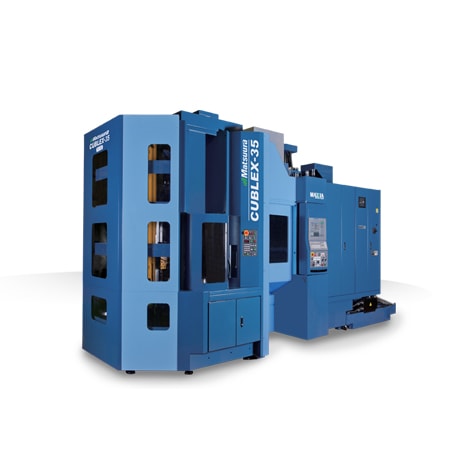

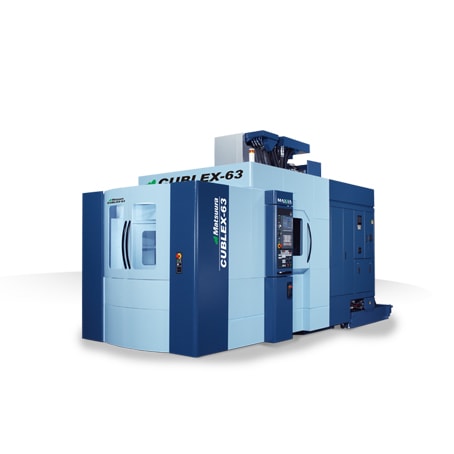

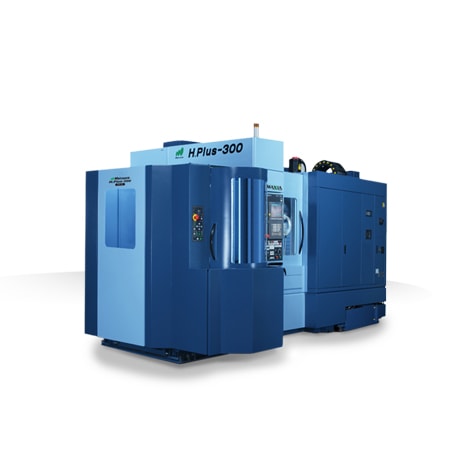

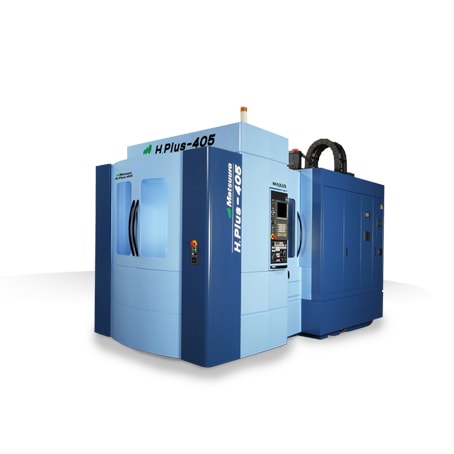

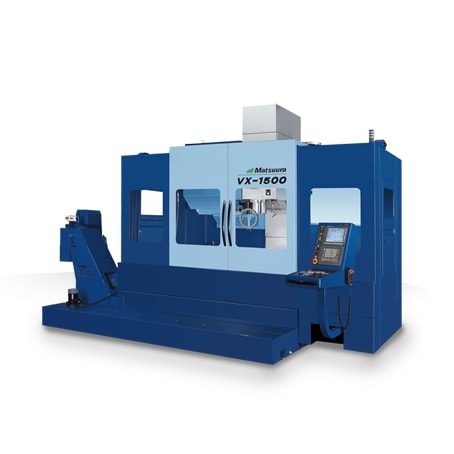

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has delivered unmatched excellence in high speed and high precision CNC machine tools. From full 5-axis, vertical, horizontal, linear motor or multi-tasking CNC machine tools, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. provides the service, applications, and technical field support that have always been the Matsuura standard for business.

For more information on Matsuura products, contact: [email protected] or visit: www.matsuurausa.com.

Matsuura Machinery USA, Inc. has created a summary of the new tax provisions for distributor partners. Matsuura Machinery USA, Inc. and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.