St. Paul, MN—(August 16, 2017) — According to the Association for Manufacturing Technology, June manufacturing technology orders climbed 6.5% over May. The latest U.S. Manufacturing Technology Orders (USMTO) report also shows a year-over-year increase of more than 10%, the fifth consecutive month posting a year-over year gain.

St. Paul, MN—(August 16, 2017) — According to the Association for Manufacturing Technology, June manufacturing technology orders climbed 6.5% over May. The latest U.S. Manufacturing Technology Orders (USMTO) report also shows a year-over-year increase of more than 10%, the fifth consecutive month posting a year-over year gain.

The U.S. manufacturing technology market has been weak since oil prices began to drop dramatically in June 2014. Orders peaked on a monthly basis that September at $643 million and bottomed out at $260 million in June 2016. IMTS – The International Manufacturing Technology Show, held in September 2016, rekindled the market, but it was not until March 2017 that year-over-year numbers began to consistently show a positive, accelerating trend upwards. Now, three months later, June figures are up 10% over June 2016 and represent the volume and growth that supports an announcement that the manufacturing technology market is officially expanding.

“If the USMTO numbers aren’t convincing enough that a recovery is underway, certainly the buzz among our members underscores that a recovery is indeed underway,” said AMT President Doug Woods. “Members have shared that the aerospace supply chain in the Midwest is hot; auto orders doubled between May and June; and sales in the Southeast exploded. Over the next six months, they look forward to a broadening of the recovery into areas like agricultural, construction, power generation and off-road machinery industries.”

The USMTO data supports the anecdotal evidence from AMT members. Automotive-related orders were up 109% from May and the aerospace industry’s bookings of new production technology were up 47%. While the largest growth by any region is the 42% increase in orders originating in the states from Tennessee north to Michigan, the Southeast and West are posting the fastest growth rates year-to-date in manufacturing technology orders.

Key indicators that businesses in the manufacturing technology sector rely on have been improving steadily. Housing starts are an important indicator of trends as every new house has at least seven new appliances, a car in the driveway, and a consumer or two with disposable income. In June, housing starts topped 1.2 million which isn’t at peak levels but continues an upward trend in the indicator. The increase goes hand-in-hand with the continuing strength of consumer confidence which, according to the University of Michigan’s Consumer Confidence, has been over 90 since September 2016.

It isn’t only the consumer that is fostering growth in the need for additional manufacturing capacity. USMTO tracks well with the Purchasing Managers’ Index (PMI) produced by the Institute of Supply Management. Any mark over 50 represents an expansion and the index is 56.3 in July, up from the June level. Business’ profitability over the past three quarters primes the pump for expansion on corporate investment in new durable goods and production equipment.

Mark Killion, director of U.S. Industries for Oxford Economics, noted, “Recent increases in new orders for machine tools are supported by a better environment for business investments in the U.S. and globally, especially in the sectors for metals products, electrical and industrial machinery.”

AMT has recently replaced one of its key indicators with the Gardner Business Index (GBI) which tracks well with USMTO and turned upwards markedly in December 2016, about 90 days before the recognizable upturn in USMTO.

“As we expected, machine tool orders have performed well in recent months. The backlog index from the GBI: Metalworking bottomed out in January 2016. The backlog index tends to lead machine tool consumption by 14 to 20 months. Since the backlog is still growing at an accelerating rate, we expect solid growth in machine tool orders through at least the end of 2017,” commented Steve Kline, director of Market Intelligence, Gardner Business Media and creator of the GBI.

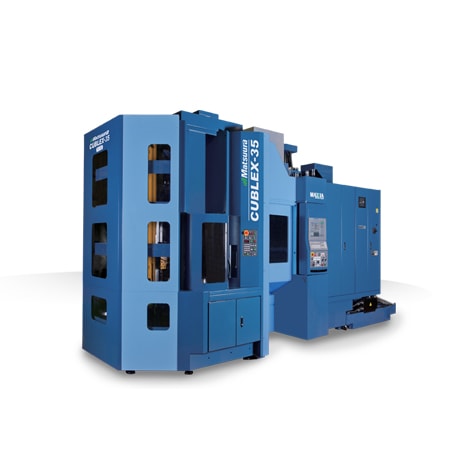

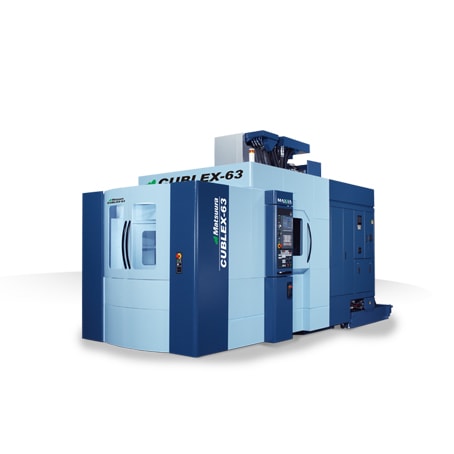

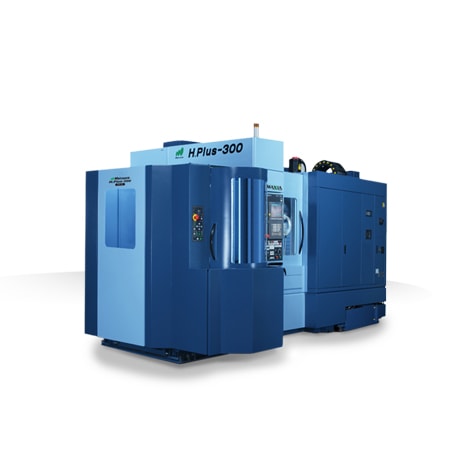

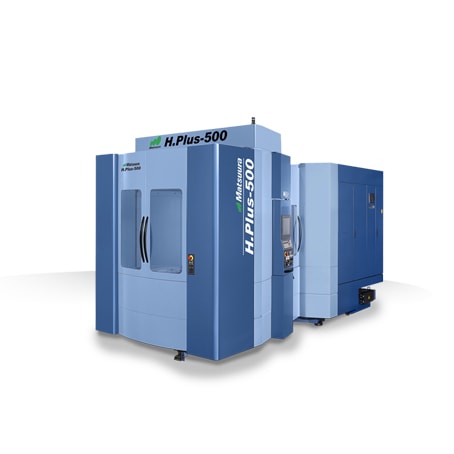

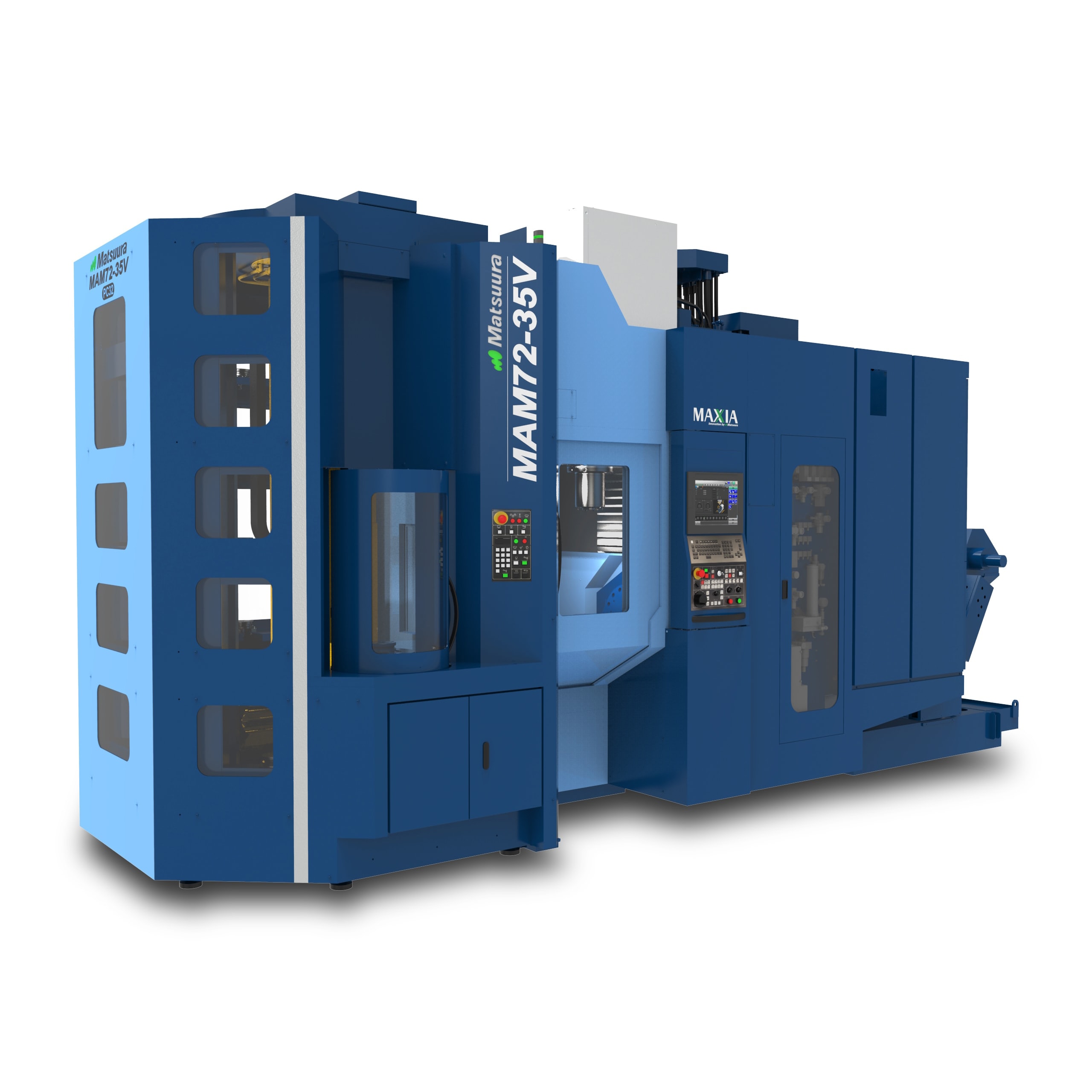

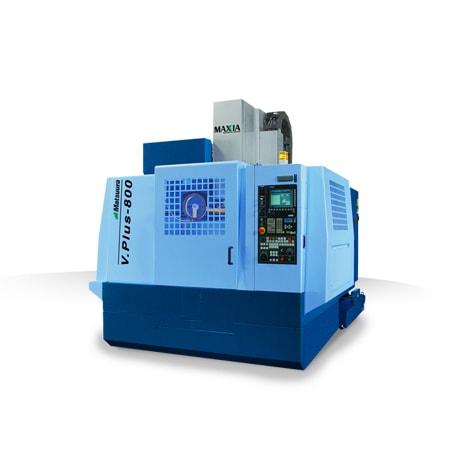

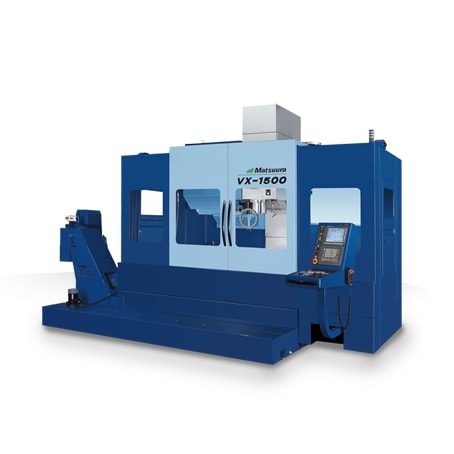

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has delivered unmatched excellence in high speed and high precision CNC machine tools. From full 5-axis, vertical, horizontal, linear motor or multi-tasking CNC machine tools, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. provides the service, applications, and technical field support that have always been the Matsuura standard for business.

For more information on Matsuura products, contact: [email protected] or www.matsuurausa.com.

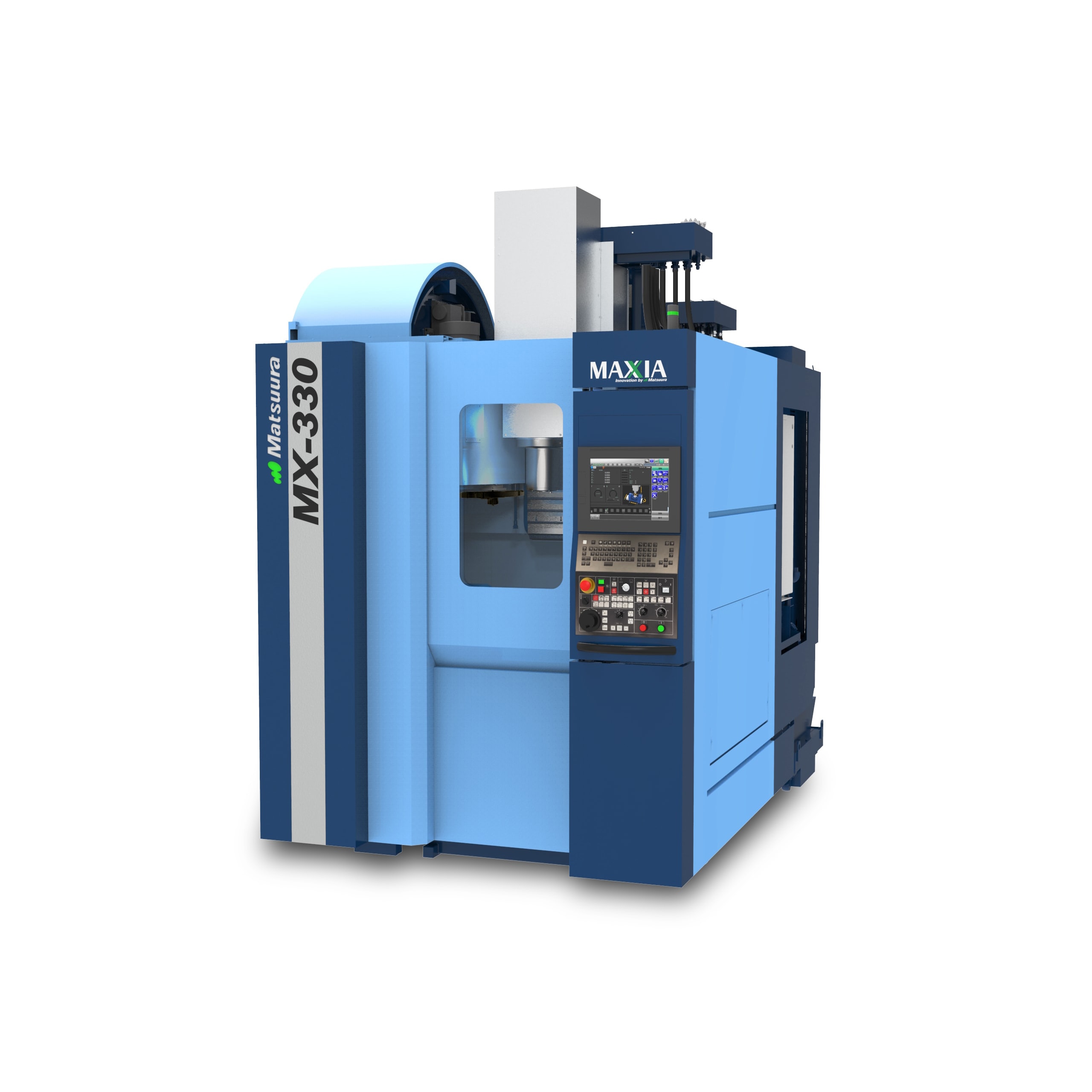

Hannover, Germany—(August 18, 2017) —The Matsuura MX-520 5-Axis Vertical Machining Center with the 4 pallet changer will debut September 18-23, […]

Hannover, Germany—(August 18, 2017) —The Matsuura MX-520 5-Axis Vertical Machining Center with the 4 pallet changer will debut September 18-23, […]